The irrefutable case for why brand investment is key to B2B growth

“Long-term effects are not simply an accumulation of short-term effects.” - The Long and Short of It

This quote from Les Binet and Peter Field’s seminal work, The Long and Short of It, encapsulates the challenge facing many organizations who enjoyed substantial growth on the back of highly-trackable, short-term activation marketing effects.

As the market matures, it becomes increasingly difficult to drive growth solely through activation-based marketing. The solution lies in rebalancing our marketing efforts to include both rational, vertically-targeted activation that delivers short-term results and emotional, broad-based brand advertising that builds a lasting connection with our audience.

This white paper leverages insights from over two decades of research by Les Binet, Peter Field, the Ehrenberg-Bass Institute, and the B2B Institute. Their extensive analysis of thousands of marketing campaigns reveals the optimal mix of brand and activation marketing that drives sustained growth while meeting short-term revenue goals.

The Principles of Long-Term Growth and Profitability

Acquiring New Customers is Essential

In the world of B2B marketing, long-term growth hinges on the continuous acquisition of new customers. This principle is not just a theoretical idea—it is a key finding from extensive research conducted by the Ehrenberg-Bass Institute and other marketing experts like Les Binet and Peter Field. The fundamental truth is that brands grow by increasing their customer base, and this growth cannot be sustained by focusing solely on customer loyalty and Product-Led Growth (PLG).

Research from the Ehrenberg-Bass Institute reveals that the most successful brands are those that consistently work to expand their customer base. In B2B markets, where the sales cycles are longer and purchase decisions are often complex, the need to attract new customers is even more pronounced. Customer acquisition drives market share growth, which in turn contributes to a brand’s long-term profitability and market dominance.

The concept of market penetration is central to this discussion. Market penetration refers to the proportion of potential customers who buy a brand within a specific market. Brands that successfully increase their market penetration do so by consistently acquiring new customers, thereby expanding their market share. This expansion is not only a driver of growth but also enhances the brand’s competitive position in the marketplace.

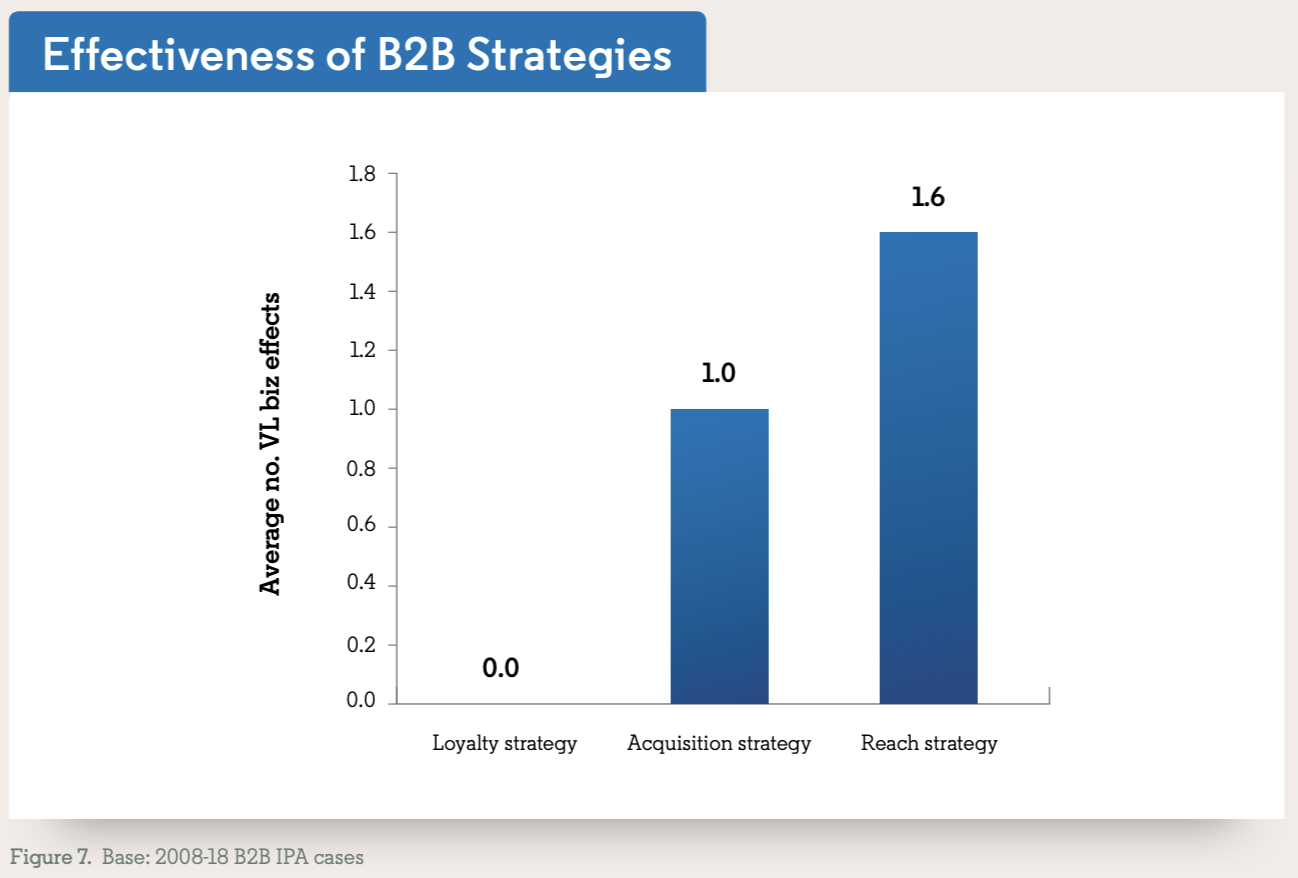

…campaigns that make brand loyalty their primary focus under-perform on every business metric. (The 5 Principles of Growth in B2B Marketing, 15)

Broad reach advertising statistically is shown to have greater amounts of very large business effects.

While customer loyalty is valuable, particularly in markets with high customer lifetime value (CLTV), it is not enough to drive significant growth on its own. The Law of Double Jeopardy, a key insight from the Ehrenberg-Bass Institute, explains that brands with larger market shares tend to have both higher customer acquisition rates and higher customer loyalty. However, this loyalty is typically a consequence of market share rather than a cause.

As The B2B Institute states in The 5 Principles of Growth in B2B Marketing, “…marketing really is a numbers game; the most successful brands tend to be those that have the most customers, and they tend to be the brands that talk to the most people in the market, most often” (18).

In other words, loyalty metrics improve as a brand grows its customer base, but focusing on loyalty without expanding the customer base will not generate the same level of growth. This is because most customers are not inherently loyal; they tend to make purchasing decisions based on availability and convenience rather than deep brand allegiance. Therefore, the path to sustainable growth lies in consistently acquiring new customers who will, over time, contribute to a larger, more loyal customer base.

Understanding Market Dynamics: Most Customers Are Not In-Market

The 95:5 rule is a general principle that helps us understand why brand advertising is key to long-term growth and profitability.

One of the key challenges in B2B marketing is the fact that most companies in any given category are not actively in the market to purchase at any given time.

For instance, assuming a three-year customer lifetime value (LTV), it is estimated that only around 33% of potential buyers are in-market in any given year, with just 8% actively considering a purchase each quarter. This statistic underscores the need for a marketing strategy that reaches both in-market and out-of-market customers. This is compounded even more by those who are a young or emerging categories where there are a significant number of potential customers that are not even clear the problem to be solved or the vendors solving them, let alone in the market to buy.

Waiting until potential buyers are actively in the market is often too late. Research indicates that 80-90% of buyers have a shortlist of brands in mind before they even begin the purchasing process. 92% of the customers with a shortlist end up purchasing one of the 3 brands from their list. If your brand isn’t on your customer’s shortlist, (perhaps because you chose to wait until the last minute to bombard them with lead-gen ads instead of proactively investing in brand marketing to build Mental Availability) your ads only have the potential to switch the mind of only 1 of those 8 in-market customers.

That’s the best-case scenario. But the reality is that most of your competitors are also spending the majority of their marketing budgets fighting to convert this one swayable prospect into a customer. This makes the “in-market” buyers even more expensive to compete for and riskier to bet all your chips on. (How B2B Tech Brands Grow, 11-12)

If your brand is not on that shortlist, you risk losing out to competitors who have invested in building mental availability long before the buyer enters the market.

Investing in Mental and Physical Availability

”Decades of empirical research have shown us that there is really only one way for brands to grow sustainably, and that is through increasing customer penetration by investing in both Mental Availability and Physical Availability” (How B2B Tech Brands Grow, 20).

To effectively acquire new customers, you must invest in both mental and physical availability:

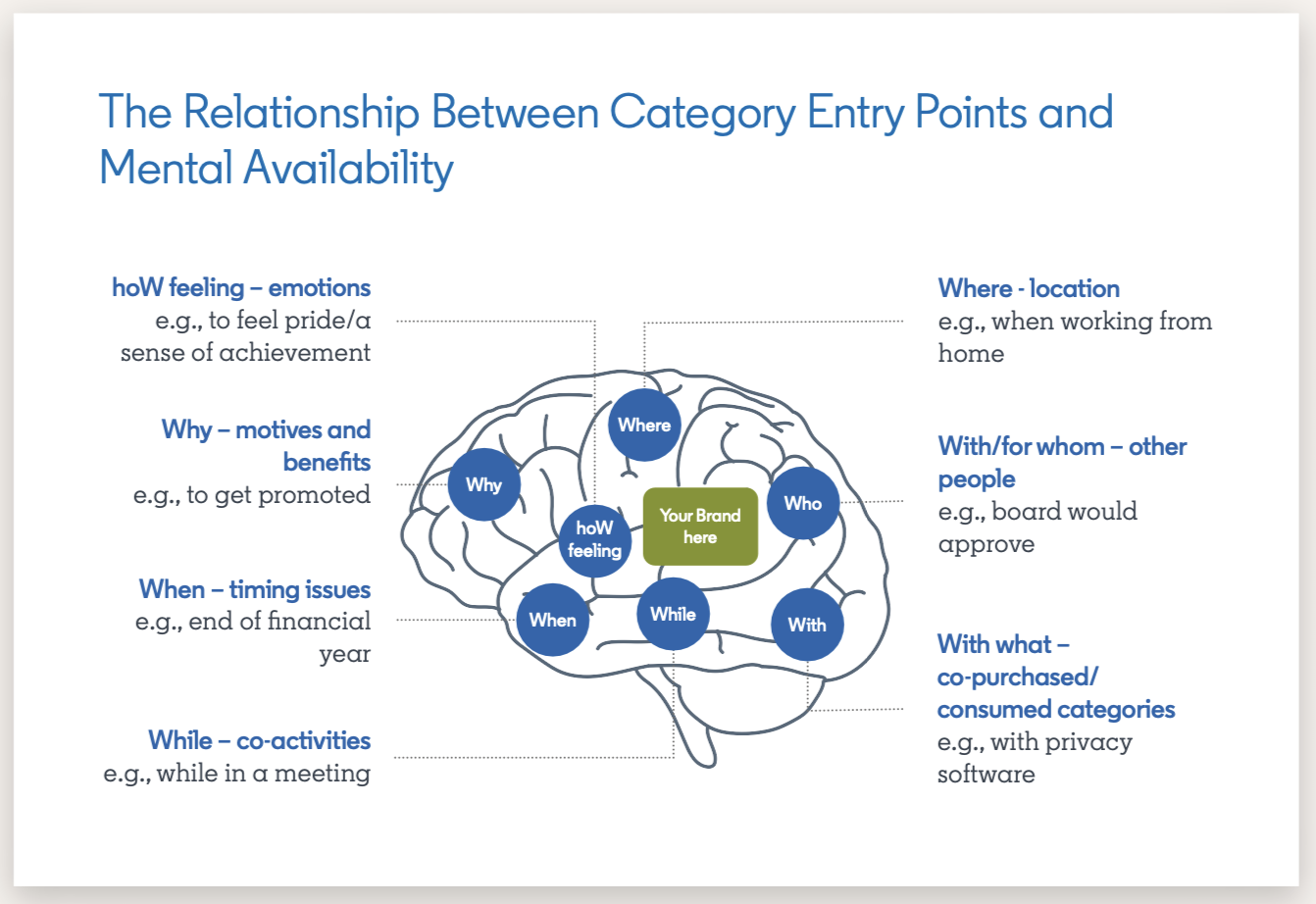

Mental Availability refers to the likelihood that a brand will be considered by potential buyers when they are ready to purchase. This is achieved by building strong brand associations and ensuring the brand is top-of-mind in buying situations.

Physical Availability ensures that when customers decide to buy, your solutions are easily accessible across all relevant channels. This includes maintaining a robust online presence, extensive distribution networks, and strategic partnerships.

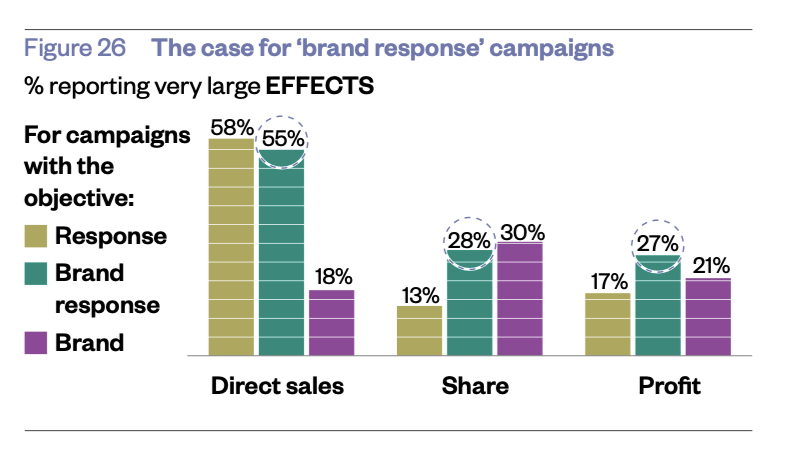

As Binet and Field emphasize in The Long and Short of It, the most successful marketing campaigns are those that combine highly creative brand-building efforts with powerful activation tactics.

These “brand response” campaigns use a central brand idea that drives long-term preference while also serving as a vehicle for short-term activation. This integrated approach is more effective and profitable than running separate brand and direct response campaigns.

Building Emotional Brand Connections

The most effective way to build mental availability is through sustained brand advertising that creates strong emotional connections with potential buyers. By consistently targeting Category Entry Points (CEPs)—the moments when customers are most likely to consider a brand—you can ensure it is top of mind when the buying decision is made.

Emotional connections centered on these category entry points are particularly powerful in driving brand preference. Building an emotional connection with as many potential buyers as possible not only aids in long-term brand building but also enhances the efficiency of short-term activation efforts. When buyers have a positive emotional association with a brand, they are more likely to respond to direct sales activation, leading to higher conversion rates and lower customer acquisition costs.

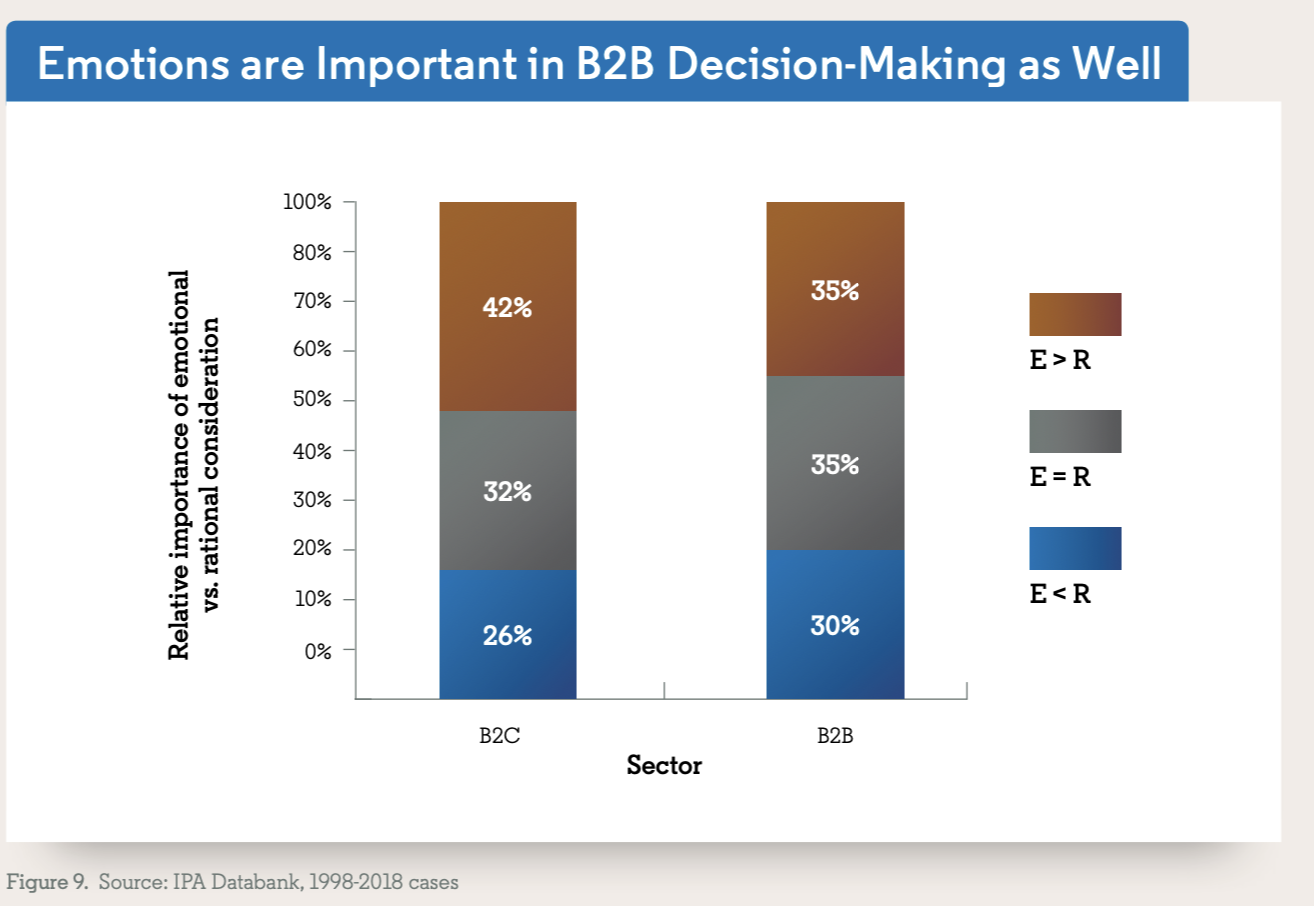

For those who might think that B2B buying is too rational to be swayed by emotions, the data does not support that assertion. As the IPA Databank shows, while rationality does play a bigger role in B2B purchase decision making, emotions are still an incredibly important component.

Building an emotional connection with as many possible buyers in the category yields significant efficiencies for short term growth

”Human beings are to independent thinking as cats are to swimming. We can do it, but we prefer not to.” - Danield Kahneman

Building an emotional connection with as many buyers as possible not only helps in long-term brand building but also yields significant efficiencies in short-term activation efforts. When buyers have a positive emotional connection to a brand, they are more likely to respond to direct sales activation efforts, resulting in higher conversion rates and lower cost per acquisition.

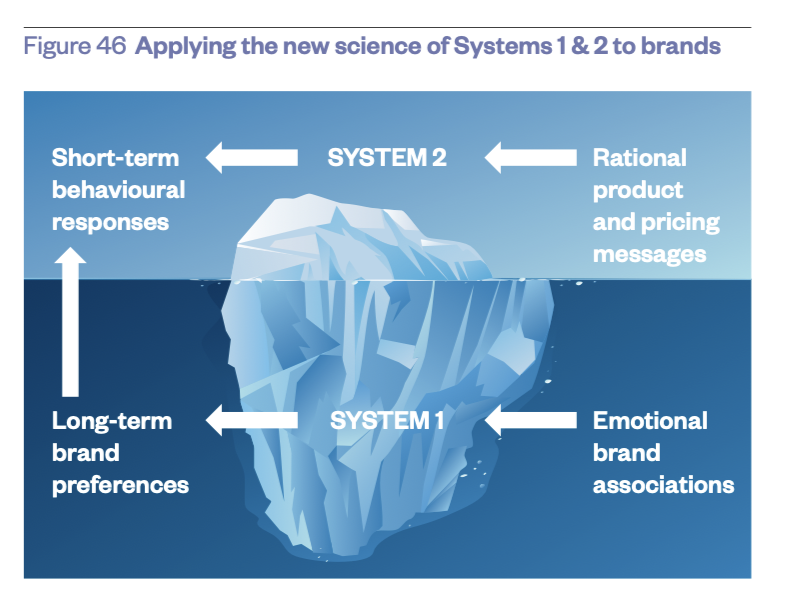

This is a byproduct of modern scientific understandings of how humans make decisions using two systems. System 1 is the brain’s fast, automatic, and intuitive mode of thinking, used for quick decisions and immediate reactions, often driven by emotions and past experiences. System 2 is the slow, deliberate, and analytical mode, requiring conscious effort for complex problem-solving and rational decision-making. In marketing, System 1 is targeted with emotional and intuitive messages, while System 2 is engaged for detailed, rational information.

System 1 runs nearly automatically and is much easier for us to access than system 2 thinking. While B2B purchasing is more rational, it is most often the case that a period of months or years of system 1 emotional priming for a brand feeds into system 2 thinking when a buyer is in market. In essence, humans use what they perceive as rational thinking to justify an already decided upon emotional decision.

Kahneman can help explain why this should be the case. Rational campaigns require us to use System 2 – doing so requires a lot of effort, so we only do it if we are actively engaged in thinking about a purchase decision, or if we are confronted with interesting news, such as a price offer or a new product…People who are not actively engaged in purchasing tend to screen out rational product messages, but emotional influences are much less likely to be filtered (The Long and Short of It, 56).

In The Long and Short of It, Binet and Field show that focusing your advertising on building emotional connection over a long period of time yields the greatest business results.

And the B2B Institute has further explored these principles in B2B marketing to show that the combination of long-term emotional brand advertising coupled with targeted activation advertising for those in-market to buy yields significant efficiencies.

The 60:40 Rule: Optimal Spend Split

Binet and Field propose the 60:40 rule for the optimal balance between brand and activation spend. In B2C markets, this split favors brand building due to the dominance of emotional priming over rational messaging.

In B2B, the ratio shifts slightly to 46% for brand and 54% for activation, reflecting the more rational nature of B2B buying decisions. However, even in B2B, emotions play a significant role, and brand building remains critical.

In rational categories, such as B2B tech, it is paradoxically more important to invest in brand advertising, not less. Rational decision-making processes can make buyers more resistant to brand messages, but this resistance can be overcome with sustained, emotionally resonant brand campaigns.

Activation works particularly well when the buying decision involves a lot of conscious, rational thought. People respond immediately to direct activity and promotions, perhaps because these require more conscious attention and tend to work on a more rational level. But in very rational categories it is slightly harder (although still important) to build strong brands. It seems that when consumers think hard about the purchase, they become slightly more resistant to brand activity…this means advertisers should spend more on brand advertising in rational categories, not less. (Effectiveness in Context, 13)

“The win-win strategy emerging from the analysis so far,” write Binet and Field, “is to ensure that brand-building activity is in place to drive sustained long-term volume growth in tandem with reduced price sensitivity, allied with short-term activation activity that is not price-based and so will not increase price sensitivity” (The Long and Short of It,, 22).

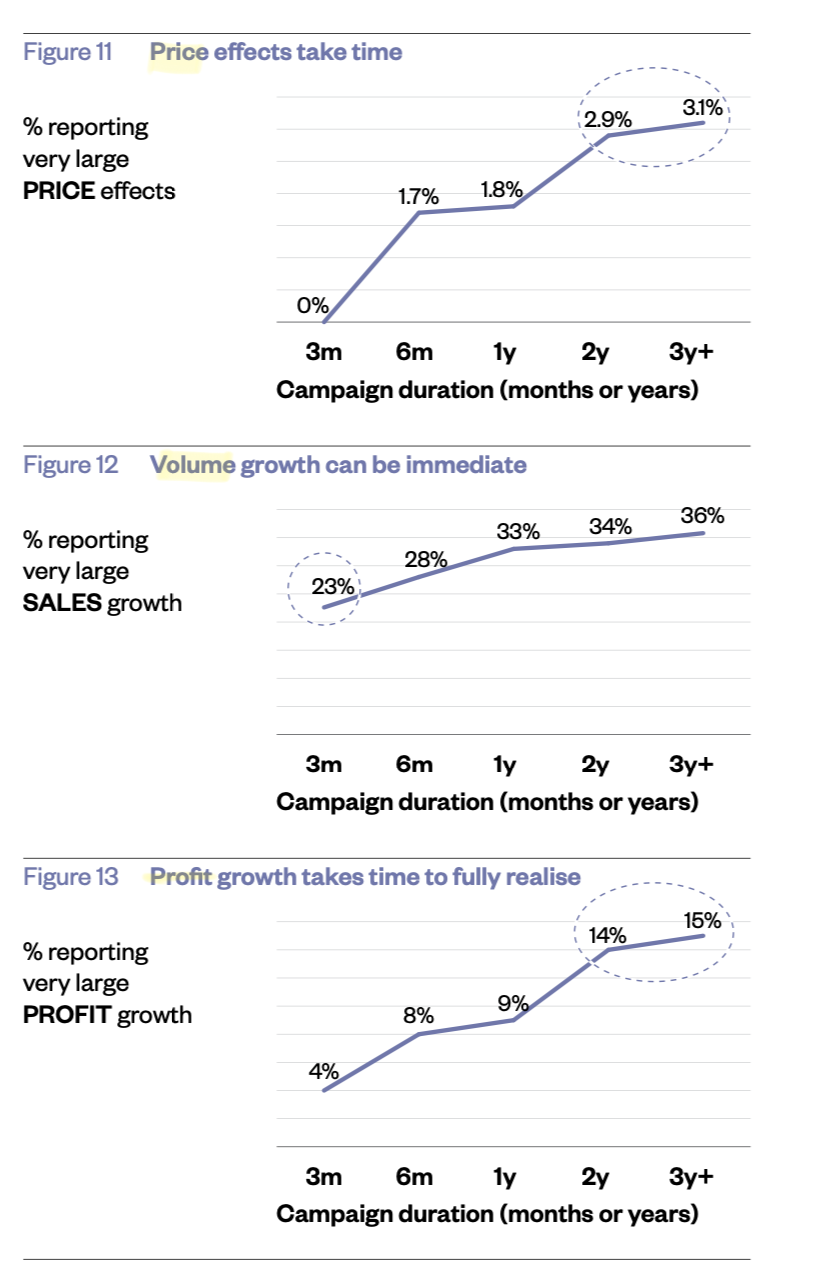

The key to success in this game is to commit to a long period of brand spend to see the desired long-term effects, including the efficiencies desired in activation ad spend.

“…the practical implication is that, if sales success is measured over a period of less than 6 months, then the metric will favour short-term communications and marketing tactics; if over longer than 6 months, then the metric will favour long-term communications and marketing” (The Long and Short of It, 70).

As a bonus, brand building over a long period of time also has the positive effect of increasing margin through pricing premiums while also growing volume.

Measuring Success: Extra Share of Voice (ESOV)

Extra Share of Voice (ESOV) is a standard metric for assessing the potential for long-term growth. ESOV is calculated as the difference between a brand’s Share of Voice (SOV) and its Share of Market (SOM). A positive ESOV indicates that a brand is investing more in advertising than its current market share would suggest, which typically leads to market share growth over time.

To maximize the effectiveness of marketing efforts, you should aim to achieve a positive ESOV by increasing its brand investment relative to its market share. This strategy will drive large profit gains and substantial business effects, positioning your brand as a market leader.

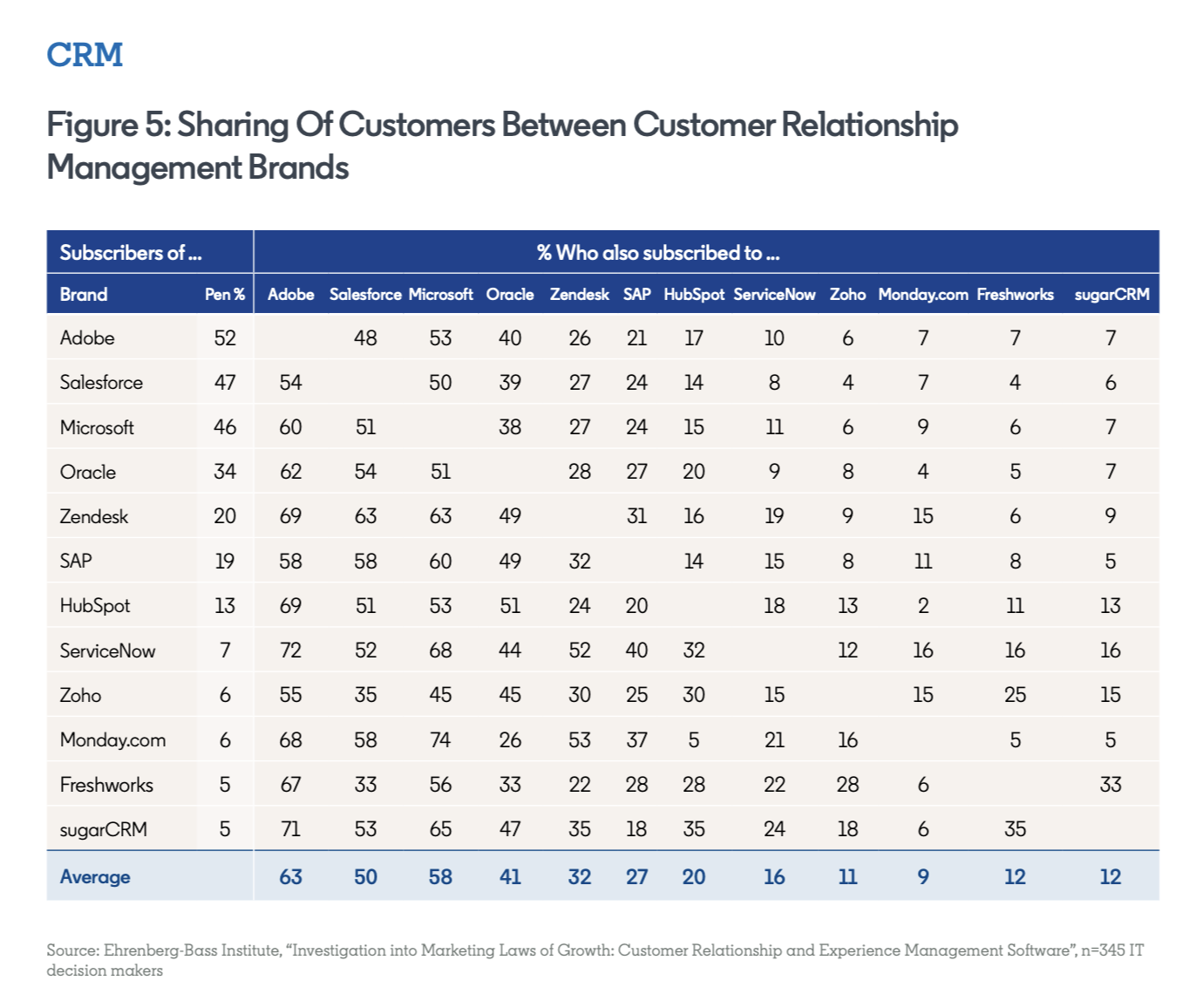

The Law of Duplicate Purchase: Gaining Competitive Customers

In any competitive market, most new customers will come from the biggest category competitors, and most churn will result in customers leaving for those same competitors. This phenomenon is known as the Law of Duplicate Purchase. To grow, you must gain more customers from competitors than it loses, which requires a competitive marketing spend and a compelling brand presence.

The practical implication of this is that we should show up where our biggest competitors show up and match or exceed their SOV. It also implies that we should be less concerned with spending time and money focused on our smaller competitors, as it is normal that in any category you’ll have customers move between brands, with a disproportionate amount to the largest brands.

This example in the CRM category shared in How B2B Tech Brands Grow shows this law in effect.

The Law of Double Jeopardy: The Halo Effect of Market Penetration

As you increases market penetration, you will also experience a corresponding increase in customer loyalty—a phenomenon known as the Law of Double Jeopardy. Brands with larger market shares tend to have higher customer loyalty metrics because they are more frequently chosen and top-of-mind for buyers. Therefore, focusing on market penetration will not only grow your customer base but also enhance loyalty and retention.

”The Double Jeopardy Law tells us that these big tech brands are big because they have more customers, not just because they have customers who are more loyal. Their data shows us the path to growth is through penetration; it’s simply not enough to drive growth through product loyalty” (How B2B Tech Brands Grow, 24).

Again, this proves to be true in the CRM category per The B2B Institutes analysis of the data.

Conclusion: A Strategic Shift for Long-Term Success

In conclusion, the path to long-term growth and profitability is clear: focus on acquiring new customers, increasing market penetration, and building both mental and physical availability. By rebalancing your marketing strategy to include both brand building and activation, you can ensure that you remain the preferred choice when customers are ready to buy.

This strategic shift will require a commitment to sustained brand investment and a willingness to embrace a more holistic approach to marketing. However, the potential rewards—sustained growth, increased market share, and enhanced customer loyalty—make this investment not only worthwhile but essential for your brand’s continued success.

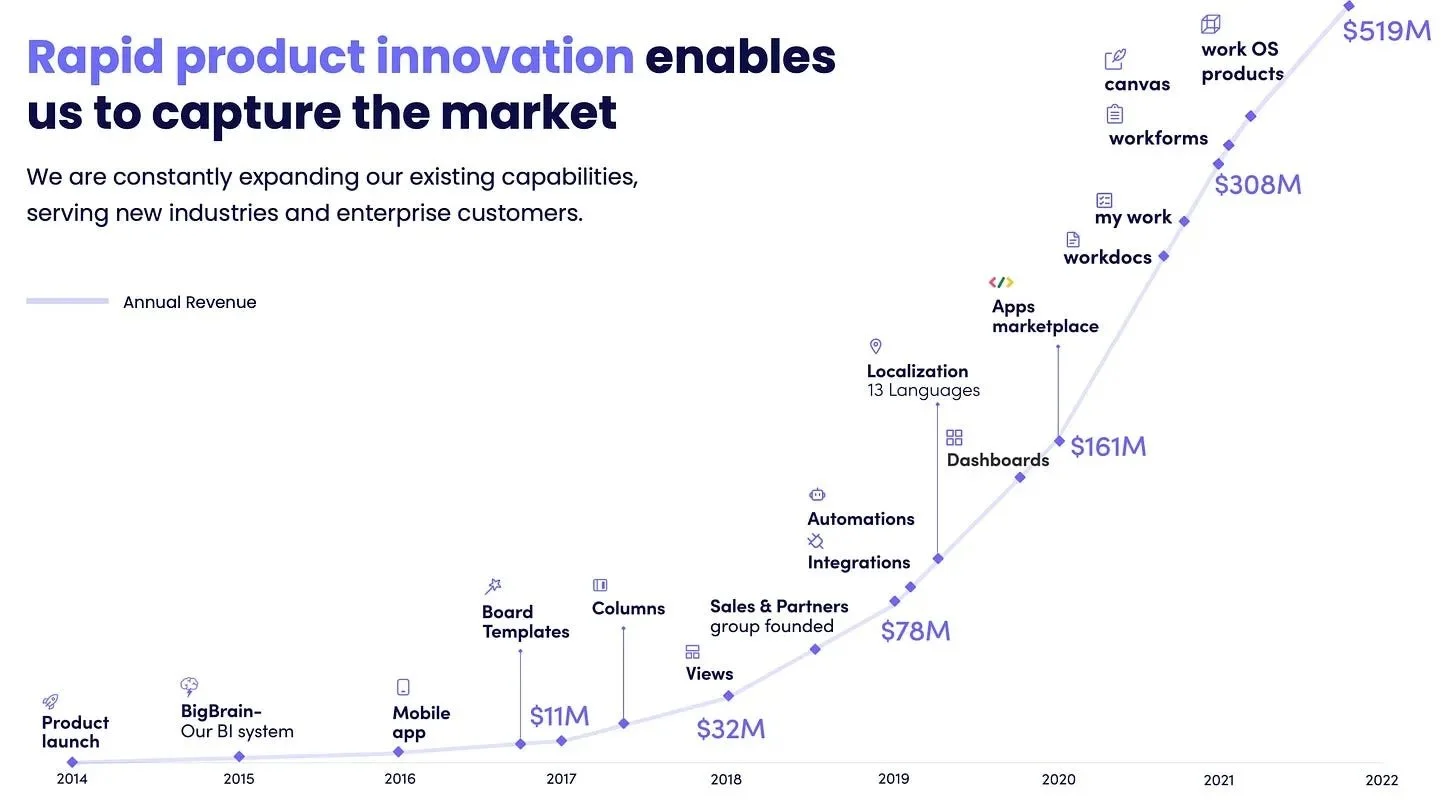

Case study: Monday.com, massive growth through brand and activation harmony

Monday.com has experienced tremendous growth over the past six years. Launched in 2014, the brand experienced modest success in the CRM and project management market, achieving $11M in ARR by 2017. That growth was largely built on the back of the standard SaaS GTM playbook of exact targeting and activation advertising. They even published a self-congratulatory post on their blog in 2017, touting their strategy.

In 2018, Monday.com started a shift in their advertising strategy. They moved from purely targeted performance marketing in online channels to experimenting in brand. That year, they placed their first Out of Home (billboard, etc.) ads in select geographies. They found the strategy to be successful.

”As part of that effort, we started to do a lot of out-of-home campaigns around 2018, starting primarily in the US, because it’s our largest market. After a couple of campaigns in New York and San Francisco, we expanded to London and realised that this approach really moves the needle in brand awareness,” shares Aviv Bar Oz, the brand marketing lead at Monday.com.

It is perhaps not a coincidence that Monday.com started to see exponential growth in revenue around the same time it diversified its marketing spend between brand and performance marketing.

Since 2018, the company has expanded their brand marketing significantly, culminating in a Super Bowl ad campaign, “Work without limits,” in 2022.

Key outcomes of the campaign included:

Increased Brand Visibility: The Super Bowl ad alone reached over 30 million viewers across major U.S. markets. This exposure, combined with additional out-of-home advertising and digital channels, significantly boosted Monday.com’s brand recognition, especially in competitive markets.

Growth in Customer Base: Following the campaign, Monday.com reported a 231% year-over-year increase in enterprise customers and a 95% increase in revenue. This suggests that the campaign not only raised awareness but also translated into tangible business growth.

Enhanced Market Positioning: The campaign effectively positioned Monday.com as a leading player in the work management software space, particularly by emphasizing its adaptability across various industries. This helped differentiate them from competitors and attract a broader audience, including non-technical users.

Cross-Channel Integration: The campaign was supported by a mix of traditional and digital media, including influencer marketing, which significantly amplified its reach. The integration of these channels helped Monday.com exceed their social reach goals by 1790%, showing the power of a well-coordinated marketing strategy.

In August of 2024, Monday.com announced a major milestone of $1B in ARR. That represents nearly 100% growth since 2022. They also announced the launch of their newest brand campaign, “For whatever you run,” focused on a fictitious company running a pod of Orca whales. This reinvestment in brand is a strong signal that Monday.com believes fully in the power of emotional brand advertising to grow its brand for the long term.

Crucially, Monday.com did not rely solely on brand advertising, but instead used best practices such as those laid out in this white paper to amplify their brand spend through strategic activation marketing and product-led growth.

Monday.com has publicly attributed their explosive growth to a few key factors:

Product-Led Growth: Their platform is designed to be highly intuitive and customizable, which has driven strong word-of-mouth and organic growth.

Scalable Marketing: By investing in both performance and brand marketing, Monday.com has been able to scale its customer acquisition while also building brand recognition.

Broad Market Appeal: They have effectively positioned themselves across multiple industries, from tech to healthcare to construction, which has broadened their market reach.

Data-Driven Decisions: Their use of advanced analytics to measure the impact of their marketing efforts has enabled them to optimize their campaigns continuously, ensuring both efficiency and effectiveness in their marketing spend.

They were especially focused at the activation level of marketing on key verticals in non-tech spaces such as real estate, banking, construction, and even churches, as SaaStr reports.

Monday.com continued to employ highly targeted performance marketing strategies aimed at specific verticals. By focusing on industry-specific messaging and using data-driven insights, they tailored their product features and marketing campaigns to the unique needs of these verticals. For example, they ran campaigns in sectors like construction, healthcare, and education, emphasizing the adaptability of their Work OS to various workflows without requiring technical expertise. This dual approach allowed them to capture both broad and niche markets effectively.

Their ability to combine broad brand advertising with precise performance marketing in specific verticals was a key factor in their growth. By building a strong brand identity while simultaneously addressing the distinct needs of different industries, they were able to scale rapidly and maintain relevance across a wide array of market segments.

The sources for this white paper

Read the following reports if you wish to dig deeper into the insights shared in this report:

The Long and Short of It by Les Binet and Peter Field

Effectiveness in Context by Les Binet and Peter Field

The Five Principles of Growth in B2B Marketing by The B2B Institute

How B2B Brands Grow by The B2B Institute

How B2B Tech Brands Grow by The B2B Institute

The reports listed above represent 373 pages of research findings compiled over multiple decades from analysis of data from the following primary data sets.

IPA Effectiveness Databank

Description: The IPA Effectiveness Databank is one of the most comprehensive sources of advertising effectiveness data, compiled from submissions to the IPA Effectiveness Awards. It includes over 1,500 case studies spanning nearly 40 years. This database includes comprehensive details on business, targeting, creative strategies, budgets, media, and business results.

Key Metrics: The Databank tracks various metrics, including business effects (e.g., sales, profit, market share), campaign duration, communication channels used, and creative awards.

Trust Factor: The IPA Effectiveness Databank is recognized industry-wide for its rigorous data collection and validation processes. The insights derived from it are based on real-world campaigns and have been peer-reviewed over decades.

The Ehrenbert-Bass Institute for Marketing Science

Description: The Ehrenberg-Bass Institute for Marketing Science is the world’s largest center for research into marketing, known for its evidence-based approach to understanding how brands grow.

Key Metrics: The reports emphasize concepts like Mental and Physical Availability, drawing on data about brand recall, penetration, and market share growth from extensive longitudinal studies conducted by Ehrenberg-Bass. It also introduces laws such as Double Jeopardy and the 95-5 Rule, which are backed by decades of empirical research.

Trust Factor: The Ehrenberg-Bass Institute is highly respected for its empirical approach and has revolutionized modern marketing with its findings. The research is grounded in extensive, real-world data and is used by many of the world’s leading brands.

Industry and Academic Research

Description: The reports also draw on a range of academic studies and industry research, particularly in areas such as consumer behavior, pricing elasticity, and the psychology of marketing effects. This includes work by marketing scholars like Peter Drucker and Byron Sharp, whose findings on brand growth and loyalty are frequently cited. Additionally, data from LinkedIn Advertising is incorporated.

Key Metrics: These studies provide theoretical and empirical foundations for understanding how long-term brand building and short-term activation campaigns affect consumer behavior and business outcomes.

Trust Factor: The research cited in the reports comes from well-regarded academics and institutions, providing a solid scientific basis for the insights presented.

Real-World Case Studies

Description: The reports extensively analyze case studies from the IPA Effectiveness Databank, which includes data from a wide range of industries, including B2B, FMCG, financial services, and more. These case studies provide detailed examples of how different marketing strategies have performed in practice.

Key Metrics: The case studies include data on market share growth, profit increases, return on marketing investment (ROMI), and the effectiveness of different campaign types (e.g., brand vs. activation).

Trust Factor: The use of real-world case studies ensures that the findings are grounded in practical, actionable insights. The outcomes observed in these cases are directly relevant to the strategies being proposed.

Gunn Report (Creativity and Effectiveness Data)

Description: The Gunn Report is a global index of creative excellence in advertising, tracking campaigns that have won awards at major creative competitions around the world. It provides data on the relationship between creativity and business effectiveness.

Key Metrics: The report measures the effectiveness of creatively awarded campaigns compared to non-awarded ones, linking creativity directly to business outcomes like market share growth and profitability.

Trust Factor: The Gunn Report) is a globally respected source, used by top agencies and brands to benchmark creative effectiveness. Its data is considered authoritative in demonstrating the value of creativity in driving business results.